2025 will be a game-changing year for UAE businesses. The Federal Tax Authority (FTA) is simultaneously implementing nationwide e-invoicing legislation forcing all companies with a VAT registration to transition from paper or partially digital invoicing to an entirely automated, electronic structure. This diktat is part of broader digi-transformation efforts being pursued by the UAE government, […]

UAE’s E-Invoicing Initiative

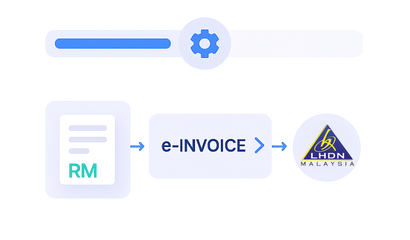

The UAE Federal Tax Authority (FTA) has introduced a mandatory e-invoicing framework to modernize VAT compliance, enhance transparency, and reduce invoice fraud. Under this framework, VAT-registered businesses will issue structured Peppol PINT AE XML e-Invoices and credit notes, exchanged entirely through Accredited Service Providers (ASPs) operating on the Peppol network. A controlled pilot and voluntary adoption phase begins 1 July 2026, followed by mandatory adoption for large taxpayers (annual revenue ≥ AED 50 million) from 1 January 2027, with additional phases for remaining VAT-registered businesses and government entities later in 2027.

Advintek’s e-Invoicing solution enables enterprises to adopt these requirements seamlessly. Our platform automates compliant invoice creation, conducts validation checks aligned with ASP rules, ensures secure routing through accredited channels, manages digital archiving per UAE retention laws, and integrates smoothly with ERP and accounting systems reducing complexity, manual effort, and compliance risk.

How Advintek Simplifies E-Invoicing in UAE

More efficient compliance

Easier to use

Successful e-Invoice submissions

Errors eliminated

Industry Served:

Powering UAE’s e-Invoicing Evolution

We work with some of UAE’s most established and fast-growing companies. Whether you're in healthcare, logistics, technology, or manufacturing chances are, we’re already powering your industry.

10+ Years

3000+ Clients

70+ Industries

CMMI Lvl 3

ISO 27001:2022 Certified

Why Advintek is the right choice for you

Fully Compliant Platform

Built to meet every requirement of the UAE’s e-Invoicing mandate.

Easy ERP Integration

Seamlessly connects with SAP, Oracle, Dynamics, Zoho, custom systems and more.

Real-Time Accuracy

Ensures correct invoice structuring, ASP-compliant delivery, and reduced submission failures.

Secure Cloud Storage

Provides audit-ready digital records with encrypted access and compliant retention policies.

Automated Workflows

Eliminates manual processes, improving VAT reporting accuracy and overall operational efficiency.

Local Support Team

UAE-based compliance specialists offering onboarding assistance and continuous implementation guidance.

Timeline of E-Invoicing Adoption in The UAE

Pilot Programme — 1 July 2026

Selected businesses under the Taxpayer Working Group begin issuing structured e-Invoices as part of the FTA’s controlled pilot rollout.

Voluntary Adoption — From 1 July 2026

Any VAT-registered business may start adopting e-Invoicing early. This phase is optional but encouraged to ease transition.

Phase 1 — 1 January 2027

Mandatory for large businesses with annual revenue ≥ AED 50 million. ASP appointment deadline: 31 July 2026.

Phase 2 — 1 July 2027

Mandatory for businesses with annual revenue < AED 50 million. ASP appointment deadline: 31 March 2027.

Phase 3 — 1 October 2027

Mandatory for all UAE Government Entities. ASP appointment deadline: 31 March 2027.

Key Highlights of UAE E-Invoicing:

Who’s Included

UAE’s e-Invoicing rules apply to all VAT-registered businesses issuing B2B and B2G invoices under the new framework.

Large Enterprise Deadline

Businesses with annual revenue above AED 50 million must appoint an ASP and begin mandatory compliance by January 2027.

Accepted Formats

Only machine-readable XML invoices using the Peppol PINT AE specification are accepted.

ASP Requirement

Accredited Service Providers are essential for generating, transmitting, validating, and securely archiving e-Invoices across all business systems.

FTA Oversight

The Federal Tax Authority will regulate compliance, validate submitted invoices, and maintain centralized government records for audit purposes.

Why Choose Advintek

FTA Aligned

We are a UAE-licensed e-invoicing solution provider, fully FTA e-invoicing norm and requirement-compliant.

ISO 27001 Certified

Protect your digital invoicing UAE processes with ISO 27001-compliant cloud infrastructure and state-of-the-art data protection.

Peppol Certified Access Point

Integrate effortlessly with the Peppol access point UAE and carry out transactions securely and reliably.

Local Expertise

Our UAE-based team provides hands-on guidance regarding FTA e-invoicing UAE compliance.

Business Solutions

We offer adaptable, cost-effective plans designed to enable e-invoicing adoption & automation for businesses of all sizes.

Enterprise Integration

Integrate seamlessly with ERP systems using APIs and tools that enable invoice automation at scale in the UAE.

Trusted by growing businesses across UAE

Excellent

4.8

Rated 4.8 out of 5 from 3,614 customer reviews.

Everything You Need to Know

What is mandatory e-invoicing in UAE 2025?

It requires all VAT-registered businesses to adopt FTA-compliant digital invoicing UAE aligned with e-invoicing standards.

How do I comply with FTA/ZATCA e-invoicing in UAE?

You must onboard through an approved e-invoicing solution provider UAE like Advintek for automation, validation, and Peppol compliance UAE.

What are the benefits of e-invoicing compliance in UAE?

It ensures faster payments, fewer errors, tax compliance, and simplified cross-border e-invoicing UAE transactions.

What is the cost of e-invoicing in UAE?

The cost of e-invoicing in UAE varies based on company size and volume. Advintek offers scalable plans for SMEs and enterprises.

Do SMEs need to adopt VAT e-invoicing in UAE?

Yes, under the mandatory VAT e-invoicing UAE 2025, SMEs must comply, gaining efficiency and automation benefits.

How does Peppol onboarding UAE work?

Advintek provides a step-by-step e-invoicing guide UAE, ensuring smooth registration and connectivity to the Peppol network.

What are the UAE government e-invoicing requirements?

Businesses must comply with FTA e-invoicing in the UAE regulations, including structured invoice formats, digital transmission, and invoice automation UAE.

Can I automate UAE B2B e-invoicing?

Yes, digital invoicing UAE solutions allow automated B2B workflows, improving accuracy, speed, and compliance.

What are the advantages of VAT e-invoicing for SMEs in UAE?

SMEs benefit from faster payments, reduced errors, simplified reporting, and improved tax e-invoicing UAE compliance.

How does Advintek support digital transformation e-invoicing UAE?

We enable businesses to implement invoice automation UAE, integrate ERP systems, and adopt Peppol e-invoicing UAE for full digital compliance.

Explore the Latest E-Invoicing Updates

The world of tax and compliance is changing fast. Governments are abandoning traditional manual invoice closure processes for real time, e-invoicing to drive improved tax collection, transparency and overall business efficiency. In the United Arab Emirates, the Federal Tax Authority (FTA) is introducing an e-invoicing mandate in 2025—a shift that will affect businesses small and […]

1 September 2025 onwards, the Inland Revenue Board of Malaysia (LHDN/IRBM) will impose interesting e-Invoicing requirements for invoice issuance in foreign currencies. Among these requirements, the issuance of invoices with MYR-equivalent values, using any approved currency exchange rate, is mandatory. This is beyond an update of existing procedural guidelines and is in line with the […]

Mergers and acquisitions (M&As) throughout Malaysia are picking up tempo because companies are looking for strategic growth opportunities, access to new markets, and digitalization. But with the usual taxation, valuation, and legal hurdles, one new element has become inseparable mandatory e-invoicing throughout Malaysia. By 2025, it is required by the Inland Revenue Board of Malaysia […]

Malaysia’s tax landscape is entering a new phase because two major initiatives will be launched in 2026: the self-assessment stamp duty system in line with the Stamp Act Malaysia and the expansion of the Sales and Service Tax (SST Malaysia). They both bring a new direction toward a higher level of taxpayer accountability and broader […]

You already know that the MyInvois mandate is reshaping how Malaysian businesses handle invoices. What most don’t realize until they’re in the thick of it is how much operational weight this shift adds to your team. Complying with e-Invoicing requirements isn’t as simple as uploading a file. It means understanding technical schemas, tax metadata, PEPPOL […]